Prototype investment

strategies online...

strategies online...

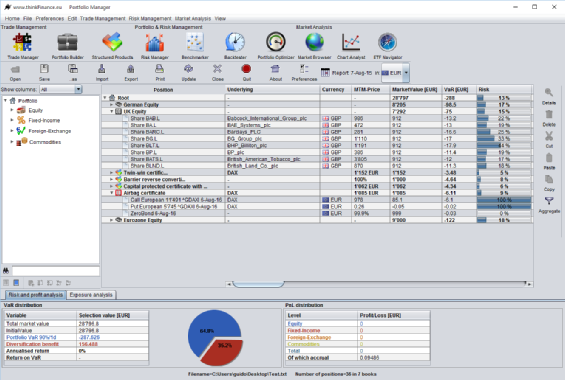

The menu bar on top

of the main window

contains the main

prototyping, risk

analysis and portfolio

optimization functions

as well as buttons for

the administration of

the portfolio

The center of the main

window contains

the position table,

which can be displayed

at different aggregation

levels (book view, flat

view), different column

views and which can

be filtered according to

asset and instrument

classes.

of the main window

contains the main

prototyping, risk

analysis and portfolio

optimization functions

as well as buttons for

the administration of

the portfolio

The center of the main

window contains

the position table,

which can be displayed

at different aggregation

levels (book view, flat

view), different column

views and which can

be filtered according to

asset and instrument

classes.

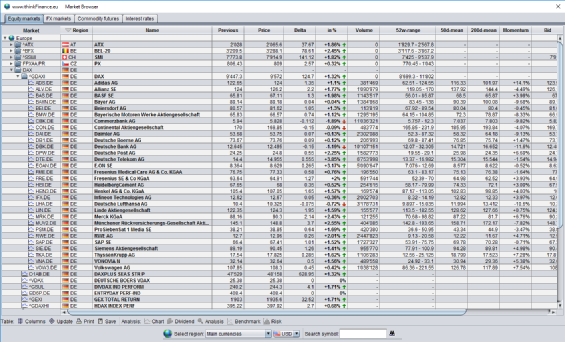

The user can either

compare the intra-day

performance of major

equity indices and drill

into one of the indices to

view the performance

of the shares contained

in the index.

The table can be sorted

with respect to all

columns.

compare the intra-

equity indices and drill

into one of the indices to

view the performance

of the shares contained

in the index.

The table can be sorted

with respect to all

columns.

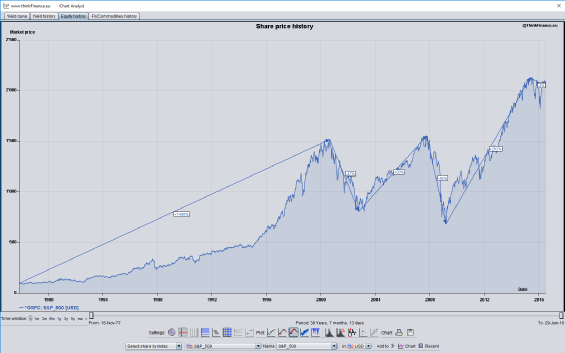

Historical market data

from the ThinkFinance

database can be plotted

and analyzed in various

ways (e.g. plot the

time series, plot a

histogram of absolute

or relative returns, plot

in different currencies,

analyze trends etc.).

from the ThinkFinance

database can be plotted

and analyzed in various

ways (e.g. plot the

time series, plot a

histogram of absolute

or relative returns, plot

in different currencies,

analyze trends etc.).

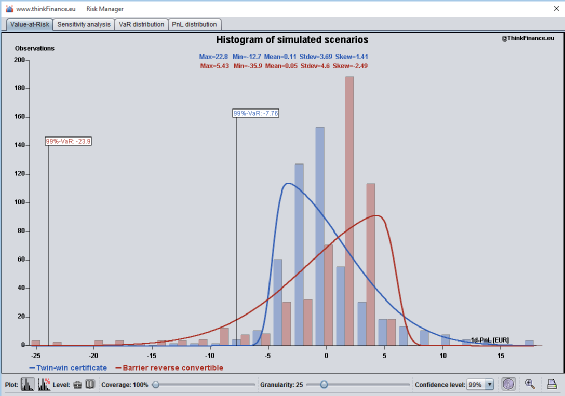

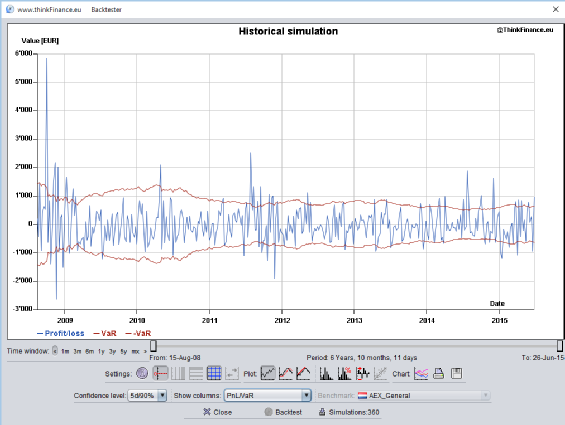

The VaR plot shows the

profit and loss

distribution calculated

using a historical

simulation and

the VaR at the chosen

confidence level.

The user can adjust the

granularity of the plot

(i.e. number of buckets)

and zoom into the tail

of the distribution.

The VaR plot can be

performed for a single

position or at a book or

portfolio level.

profit and loss

distribution calculated

using a historical

simulation and

the VaR at the chosen

confidence level.

The user can adjust the

granularity of the plot

(i.e. number of buckets)

and zoom into the tail

of the distribution.

The VaR plot can be

performed for a single

position or at a book or

portfolio level.

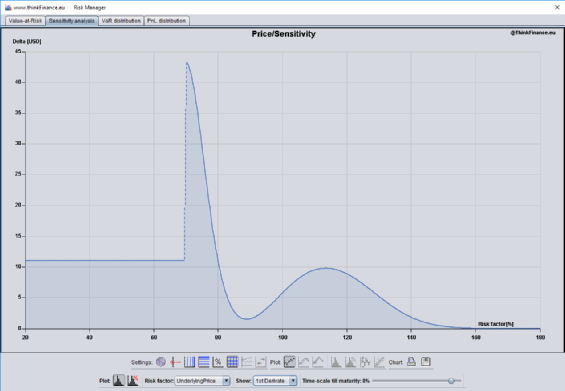

The sensitivity plot

shows the price or

„Greeks“ of a single

derivative or a book /

portfolio as a function

of a user-defined risk

factor.

The user can shift the

maturity to assess the

time-behavior of the

derivative structure.

shows the price or

„Greeks“ of a single

derivative or a book /

portfolio as a function

of a user-

The user can shift the

maturity to assess the

time-

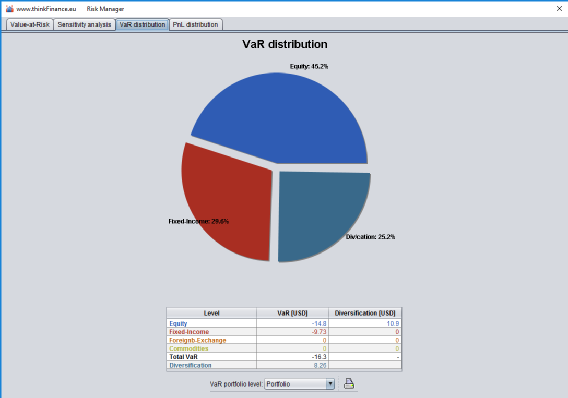

The VaR distribution

plot shows the

distribution of VaR over

assets classes or

instrument types.

Further, the user

can assess diversifi-

and across assets /

instrument classes.

The plot can be perfor-

(sub-)portfolio level.

plot shows the

distribution of VaR over

assets classes or

instrument types.

Further, the user

can assess diversifi-

and across assets /

instrument classes.

The plot can be perfor-

(sub-

The user can calculate

the evolution of the

market value, profit and

loss and VaR over time

and can plot one of

the following:

- PnL versus VaR

- the ratio of market

value over VaR

- the evolution of

market value and VaR

the evolution of the

market value, profit and

loss and VaR over time

and can plot one of

the following:

-

-

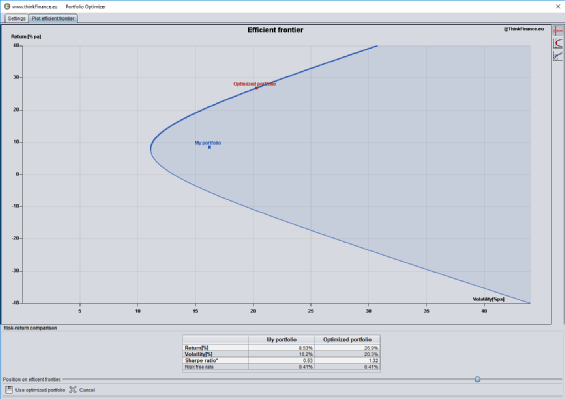

ThinkFinance calculates

and plots the efficient

frontier of the portfolio

and displays the actual

portfolio and the

efficient curve in a

return-volatility chart.

The user can select a

point on the efficient

frontier, which is then

fisplayed in detail in the

table view below.

The optimization can be

performed at a single

position level or book

level.

and plots the efficient

frontier of the portfolio

and displays the actual

portfolio and the

efficient curve in a

return-

The user can select a

point on the efficient

frontier, which is then

fisplayed in detail in the

table view below.

The optimization can be

performed at a single

position level or book

level.

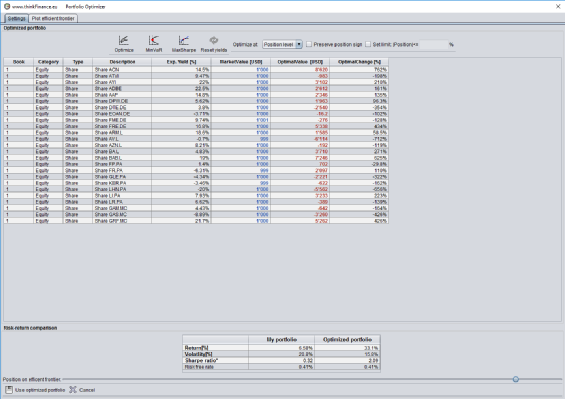

For the selected point

on the efficient frontier,

ThinkFinance compares

the asset allocation

of the actual and the

chosen (optimal)

portfolio in the upper

table.

In the lower table, the

return, the volatility and

the Sharpe-ratio of the

actual and optimal

portfolio are compared.

on the efficient frontier,

ThinkFinance compares

the asset allocation

of the actual and the

chosen (optimal)

portfolio in the upper

table.

In the lower table, the

return, the volatility and

the Sharpe-

portfolio are compared.

Learn more about

ThinkFinance

ThinkFinance

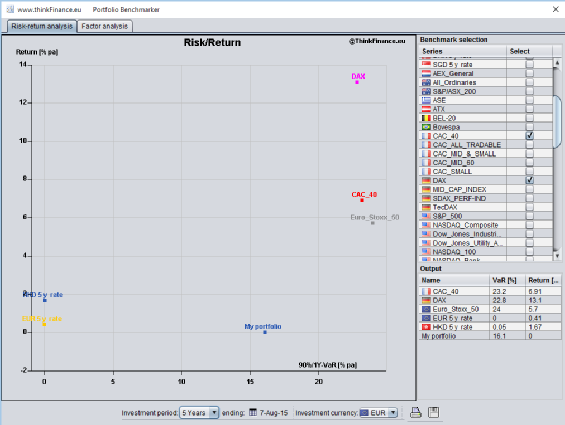

The performance and

risk (VaR) of the user´s

portfolio can be bench-

Fixed-Income indices,

based on historical

market data.

The user can select the

time horizon of the

analysis and the

base currency of the

comparison.

risk (VaR) of the user´s

portfolio can be bench-

Fixed-

market data.

The user can select the

time horizon of the

analysis and the

base currency of the

comparison.

ThinkFinance Portfolio Manager is an application you can download for free.

The following page illustrates the application's prototyping, portfolio simulation,

risk analysis and portoflio optimization functions.

The following page illustrates the application's prototyping, portfolio simulation,

risk analysis and portoflio optimization functions.

For details please refer to the instructions of ThinkFinance.

Quick tour through Think Finance

ThinkFinance Portfolio Manager offers a wide range of functions to prototype,

analyze and optimize investment strategies and to analyze financial markets -

take quick tour!

The Portfolio Manager is a versatile toolkit to build, simulate and analyze portfolios of

investments in all asset classes. In brief, Portfolio Manager allows you to:

• Manage positions in a user-defined hierarchy of books and products

• Build portfolios by drag & dropping shares, ETFs etc.

• Run historical backtests and historical Value-at-Risk calculations

• Run portfolio optimization to create MinVaR or optimal Sharpe-ratio portfolios

• Portfolio benchmarking and risk factor analysis

ThinkFinance Portfolio Manager offers a wide range of functions to prototype,

analyze and optimize investment strategies and to analyze financial markets -

The Portfolio Manager is a versatile toolkit to build, simulate and analyze portfolios of

investments in all asset classes. In brief, Portfolio Manager allows you to:

• Manage positions in a user-

• Run historical backtests and historical Value-

(click on picture to enlarge)

(click on picture to enlarge)

The Chart Analyst provides a variety of plot functions for time series analysis.

(click on picture to enlarge)

(click on picture to enlarge)

The Risk Manager calculates the risk sensitivity of a derivative:

(click on picture to enlarge)

The Risk Manager analyzes diversification benefits in your porfolio:

(click on picture to enlarge)

The Backtester runs a historical simulation of a position or a portfolio, which is

based on a full weekly re-

Top

4. PORTFOLIO OPTIMIZATION

The Portfolio Manager offers various functions to benchmark and optimize

your investment portfolio across asset classes.

The Benchmarker runs a risk-

(click on picture to enlarge)

The Portfolio Optimizer calculates the efficient frontier and optimized asset allocation

of the portfolio based on the approach of Harry Markowitz.

Efficient frontier pane:

of the portfolio based on the approach of Harry Markowitz.

Efficient frontier pane:

(click on picture to enlarge)

Optimizer pane:

1. ANALYZE FINANCIAL MARKETS

Analyze market data for Equity, Fixed-Income, FX and Commodities to spot

long-term trends or to profit from short-term market movements.

The ThinkFinance MarketBrowser summarizes the current state of equity,

fixed-income, FX and commodity markets in four summary panes.

Analyze market data for Equity, Fixed-

The ThinkFinance MarketBrowser summarizes the current state of equity,

fixed-

3. RISK AND RETURN ANALYSIS

Analyze the Value-at-Risk, the profit and loss and price sensitivity of positions,

books and portfolios.

The Risk Manager allows you to calculate the Value-at-Risk distribution:

Analyze the Value-

The Risk Manager allows you to calculate the Value-

New positions require

three types of input:

In the first pane, the

user selects the asset

class and instrument

type from various

menus.

In the second pane, the

static parameters for

the selected instrument

have to be input.

In the third pane, the

user can enter market

parameters manually or

retrieve market data for

pricing the instrument.

Once all position

parameters have

been input, the user

can analyze the risk

and sensitivity of the

position regarding its

underlying risk factors.

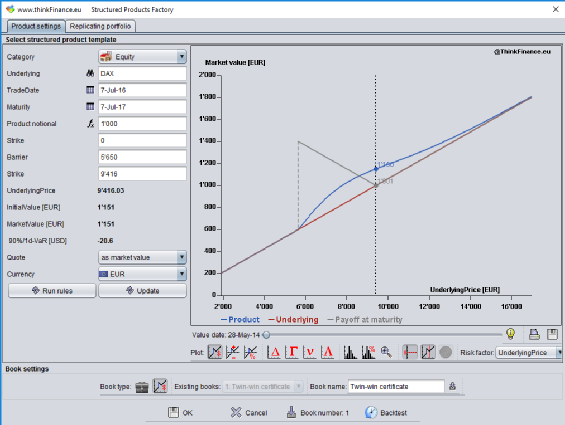

Structured investment

products are made of

various financial

instruments.

To faciliate the use of

these complex products,

the user can enter

structured products

through pre-defined or

user-defined templates.

Each product template is

defined by a replicating

portfolio and replication

rules defined in a rule

modeler.

three types of input:

In the first pane, the

user selects the asset

class and instrument

type from various

menus.

In the second pane, the

static parameters for

the selected instrument

have to be input.

In the third pane, the

user can enter market

parameters manually or

retrieve market data for

pricing the instrument.

Once all position

parameters have

been input, the user

can analyze the risk

and sensitivity of the

position regarding its

underlying risk factors.

Structured investment

products are made of

various financial

instruments.

To faciliate the use of

these complex products,

the user can enter

structured products

through pre-

Each product template is

defined by a replicating

portfolio and replication

rules defined in a rule

modeler.

(click on picture to enlarge)

(click on picture to enlarge)

The Structured Products Factory is a toolkit to define templates for structured

products, using the concept of a replicating portfolio and replication rules defined in a

sophisticated rule modeler. It also offers a wide range of simulation and risk analsis

functions.

2. PROTOTYPE INVESTMENT IDEAS

The Trade Manager is the tool to define or modify positions in securities, ETFs, FX,

commodities and derivatives:

The Trade Manager is the tool to define or modify positions in securities, ETFs, FX,

commodities and derivatives: